This tale follows the story of David Teten, founder of Versatile VC and PEVCTech.com, and the first major decision he had to make when setting up his new fund Versatile VC: selecting a new CRM. David is a prominent advocate of best-practice technology for private equity and venture capital funds, and offers valuable advice to any fund manager looking to improve their operations.

MJ Hudson - PERACS Deal Marks Yet Another Acquisition in the Private Equity Software Space

Bain & Company Acquires Sutton Place Strategies, Accelerating its Push into Private Equity Data and Analytics

S&P Global + IHS Markit: Consequences for Private Equity Data and Technology

Private Equity Middle Office Solutions Map – Portfolio Monitoring, LP Reporting, and Data

CEPRES and Bain Partner Up to Transform M&A Due Diligence Analytics

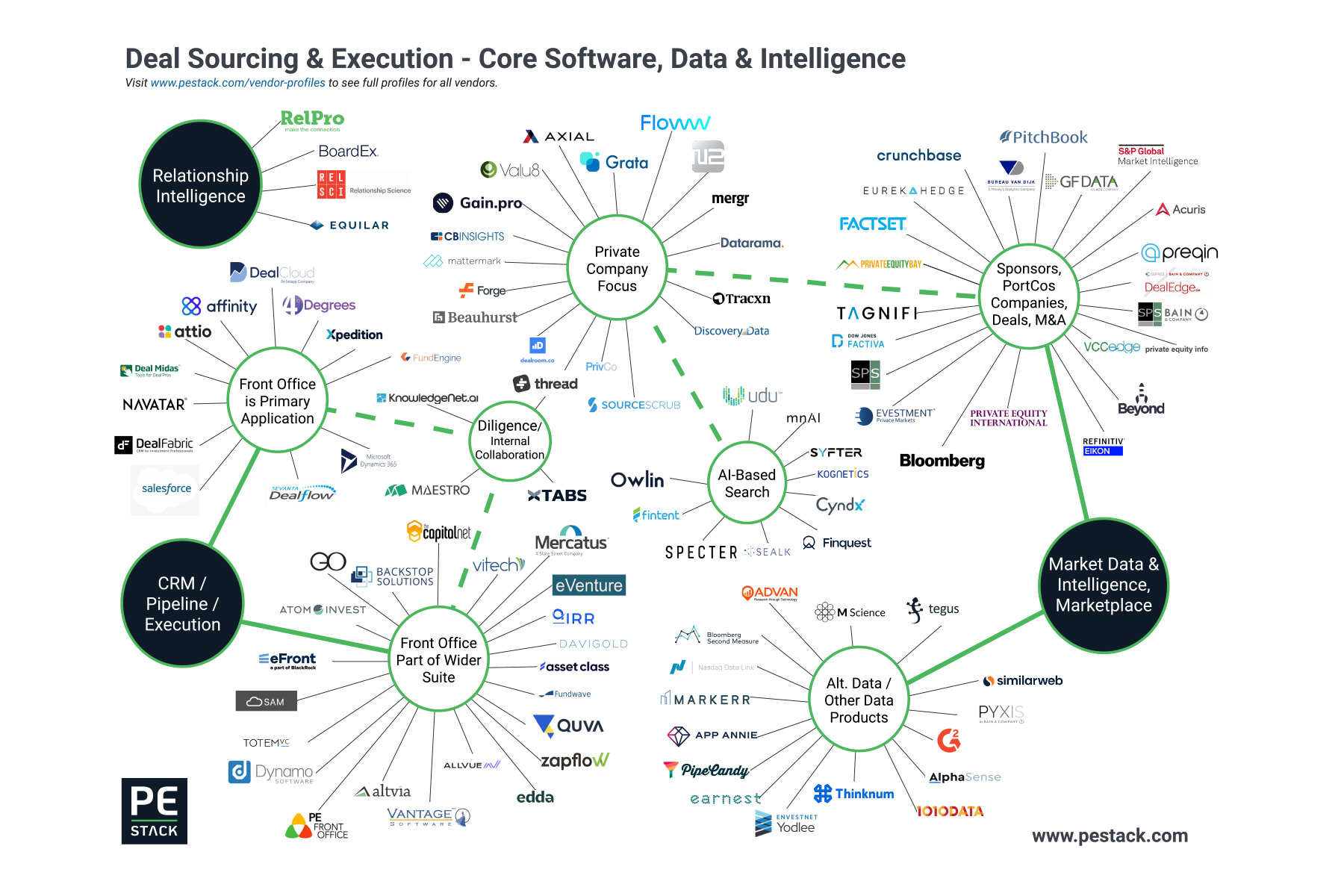

Private Equity Front Office Solutions Map - Sourcing Deals and Raising Funds

The Dynamo Effect: Imagineer The Latest Major Acquisition For Francisco-Backed Vendor

Smaller Fund Size is No Excuse for Crappy IT - Discussion with beiNVENTiV

Our focus at PE Stack is on specialized solutions for the PE and VC space, but we also encourage our clients to consider the importance of core IT and stress the advantages of working with specialized firms which understand how private capital firms operate when selecting a provider.

We sat down with beiNVENTiV to discuss COVID, how any firm can achieve institutional-grade IT regardless of size, and the importance of IT assessment during PortCo due diligence.